Banking you can trust

Service you can rely on

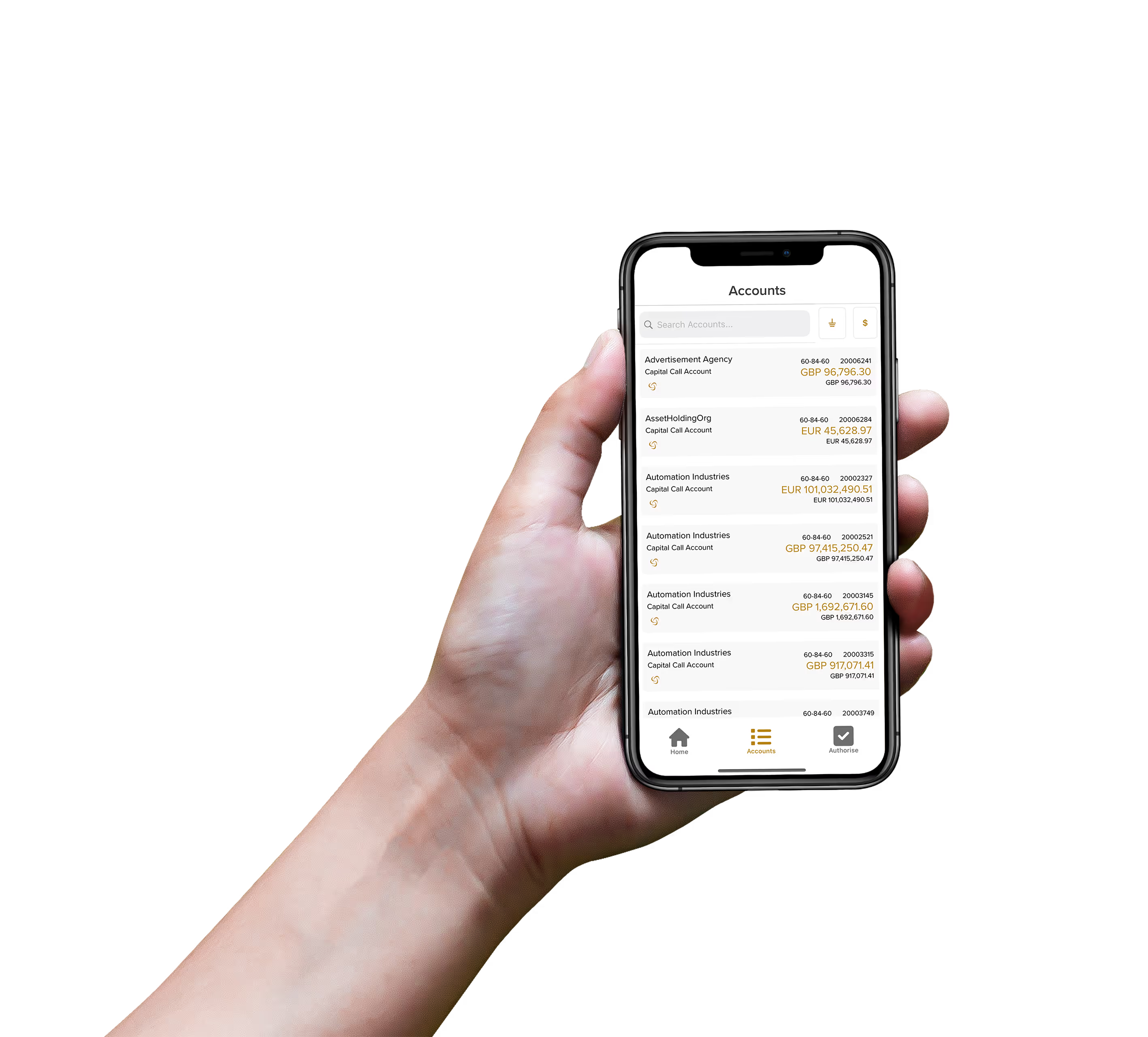

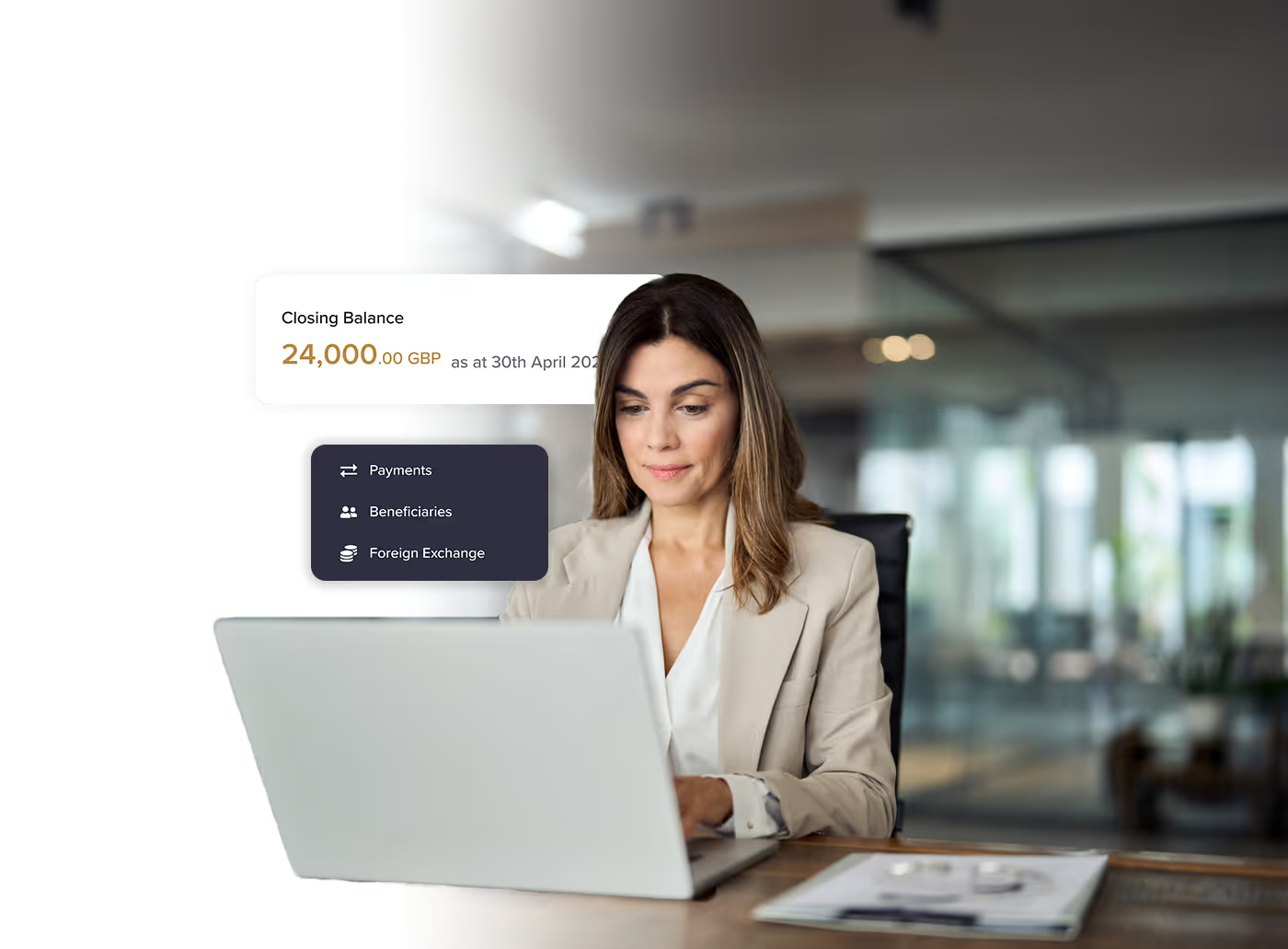

The tools you need to manage money

Efficient account opening

A range of accounts including the ‘AAAf’ rated*, same-day** access Excess Fiduciary Account

Who do we serve?

Why choose Capital International Bank?

Whilst our fees may be slightly higher than high-street banks, Capital International Bank is a lower risk option as we do not lend money placed with us.

Why choose Capital International Bank?

Whilst our fees may be slightly higher than high-street banks, Capital International Bank is a lower risk option as we do not lend money placed with us.

Led by an experienced team

Check your eligibility today

Speak to our team to find out if you are eligible to bank with us and to discover the likely costs and timescales to open an account.

Minimise your workload with a powerful set of tools that give you control over your accounts.

Multiple account types to suit your needs

Efficient decision-making

100% digital onboarding - no paper

Payments and FX in multiple currencies including all G10

Get real-time human support - don't spend hours in call queues

Fiduciary fixed term deposits available for eligible clients

Transparent pricing - no hidden fees

A modern, cloud based banking platform

Efficient account opening

Online, self-service mandates and authorisations to control permissions

Advanced reporting tools facilitate in-depth analysis

Fiduciary accounts for balances in excess of £500K (or equivalent) in a number of major currencies