Quarterly Investment Review: Q2 2022

Welcome to the Quarterly Investment Review for Q2 2022.

Our Investment team have put together a range of resources to update you on what has happened in markets across the second quarter of 2022. Here you will find:

- High-level, global equity performance analysis

- Soundbites from our team of investment experts

- A written summary covering the quarter's main market events

Global Equity Performance Analysis:

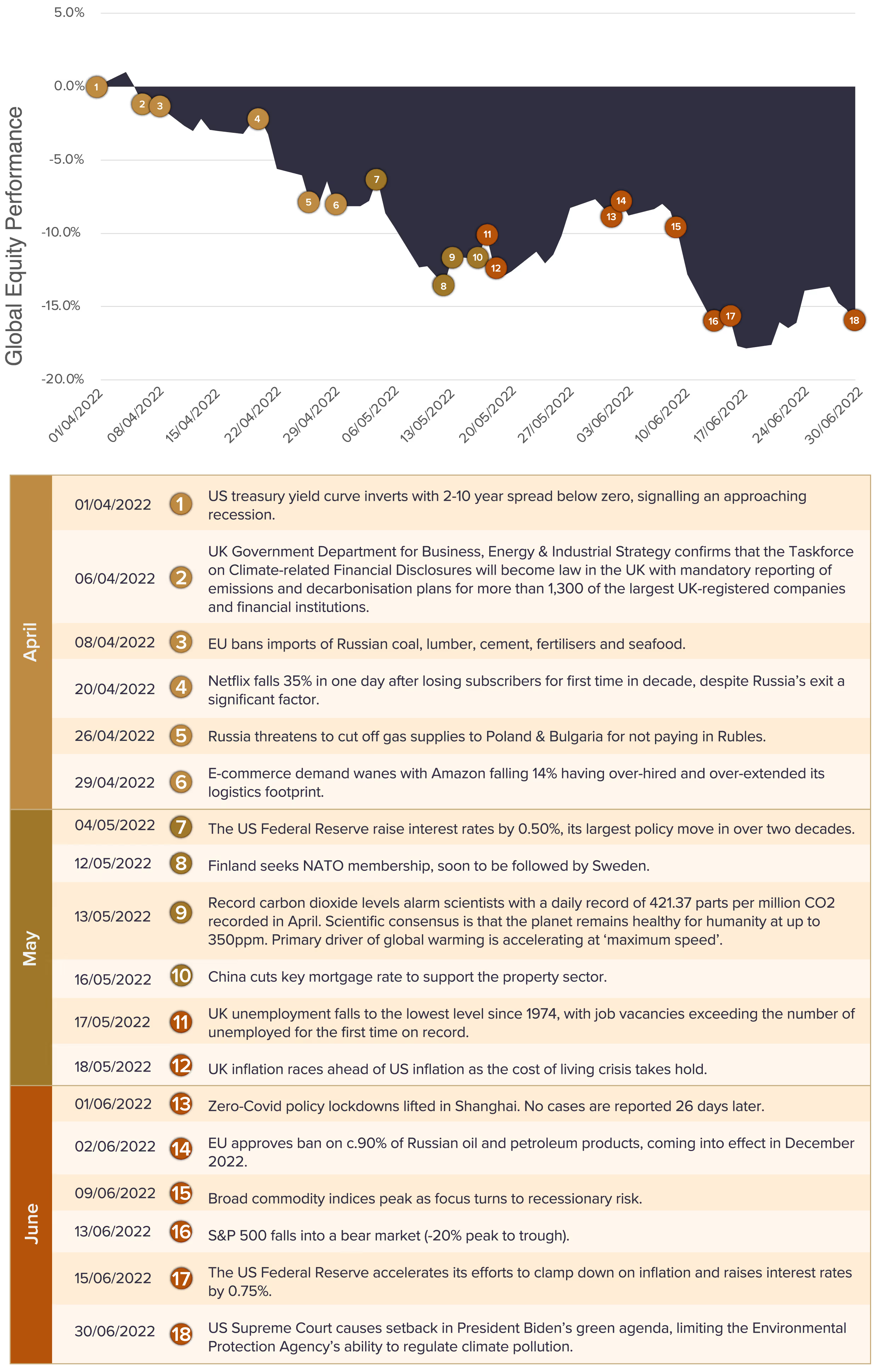

The graph below shows global equity performance across the quarter and plots world events along the performance line to indicate their impact on markets.

Hear from our Team - Investment Soundbites

Hear from our team of Investment Managers as they each explore an important topic from the quarter, be that the likelihood of a recession, soaring energy prices or inflation.

James Fitzpatrick, Head of Funds: Have we Entered A New Energy Era?

Chris Bell, Investment Manager: Inflation Running Riot: What Will Central Banks Do Next?

James Penn, Head of Equity: Are We Heading For Recession?

Greg Easton, Business Development Manager: ESG in Q2: Is It Good News?

Summary & Outlook - Q2 2022:

It has been a difficult first half of 2022 and we have seen significant retrenchment across most asset classes. Despite rebounding in the aftermath of Russia’s invasion of Ukraine, equity markets have given back most of their 2021 gains. US and European equities fell into a bear market in June and end the half down 21% and 20% respectively. The decline has been most notable in the growth-and-technology-oriented NASDAQ index which has fallen 29%. The UK has provided some refuge with the FTSE350 falling only 5.8%, reflecting its higher exposure to energy companies and the much lower relative valuation of its constituents.

What, in December, was the gentle beginnings of a pivot in central bank policy has rapidly accelerated through the first half into a full-blown clamp down on inflation. Inflation which has not only proved to be far more persistent than originally anticipated but has been further exacerbated by Russia’s invasion of Ukraine which has curtailed the supply of commodities into developed economies. On reflection, the Federal Reserve was too far behind the curve and have created additional volatility by not acting much sooner.

As central banks raise interest rates and taper bond purchasing, bond yields are destined to rise. Through the first half of the year, global aggregate bond indices fell 13.5%. Investors have been unable to seek refuge in fixed income assets and, despite proving to be a haven in the first quarter, commodities have underperformed equities since rallying in the week following the invasion. Ten-year government bond yields reached 3.5% from 1.5% in the US, 2.7% from 1.0% in the UK and 1.75% from -0.2% in Europe. The US Treasury curve has significantly flattened, reflecting the contrast between the long-term and short-term expectations for the economy, and twice inverted during the second quarter, signalling an approaching recession.

It’s a difficult balancing act for central banks as monetary policy is a blunt tool. They can ultimately only dampen aggregate demand and may therefore tip the whole economy into recession in an attempt to control inflation in one corner of the market; say, energy for example. The question over recessionary prospects; If, When and How Deep, are important for market direction from here. Bear markets typically last only six months if they coincide with a recession and the average peak to trough fall is not far from what we have already witnessed. Some parallels are being drawn with the 1970s and 1973-74 was a particularly tough extended bear market. However, there were strong nominal returns for equities over the rest of the decade. Our economic research points to the US, UK and Europe narrowly avoiding recession in the immediate future.

.avif)

The outlook also tilts heavily on the prospects for inflation, of which the largest contributors have been shelter and transport. With the dramatic shift in energy prices already behind us and as demand contracts, housing markets cool and supply-side pressures ease, we could see inflation beginning to wane.

The situation is more difficult in Europe with seemingly no meaningful solution to a natural gas crisis. The US could make the strategic decision to ramp up shale production and bolster the economies of its NATO allies.

Amid the uncertainty, corporate and household balance sheets are robust, banks are well capitalised, credit conditions remain loose, and these should help buoy the economy. The substitution of capital for labour as the wage share in GDP rises, a push for energy security, supply chain independence, net zero and ‘levelling up’ could all be drivers of a Capex boom in the years ahead. It is also important to recognise that we enter this scenario on the back of a strong, overheating economy with China now re-emerging from zero-covid policy lockdowns.

While it is very difficult to remain positive during a bear market, portfolios have already endured a significant but healthy revaluation in the first half. Inflation only needs to ease as central banks will have a preference for higher inflation over economic depression, and this could be the shift in rhetoric that improves sentiment in the second half. We still believe inflation is the greatest risk to your savings and equities are the asset class which will best protect you against inflation over the cycle.

Disclaimer: The views, thoughts and opinions expressed within this article and soundbites are those of the authors/ speakers and not those of any company within the Capital International Group (CIG) and as such are neither given nor endorsed by CIG. Information in this article does not constitute investment advice or an offer or an invitation by or on behalf of any company within the Capital International Group of companies to buy or sell any product or security or to make a bank deposit