Global equity market momentum continued in the second quarter with strong performances across developed markets: UK +6.4%, Europe +8.4%, US +8.2%. Asian and Emerging markets delivered mid-single digit returns. Japan’s equity markets, however, have been flat over the period with slow vaccination progress and nine regions only now emerging from a state of emergency.

Vaccine production issues have subsided and Europe now matches the US in delivering its population a first vaccine dose. Despite the more transmissible delta variant, which has become the dominant strain, US and UK economies are opening as they rapidly approach herd immunity resistance levels. There is sufficient evidence to suggest that acute symptoms have reduced despite rising cases and the rhetoric now promotes living with the virus instead of defeating it. The inherent risk seems to have largely dissipated in the developed world but there will be fear and uncertainty through the final stages of transition. For emerging economies and some parts of Asia, it will take more time, possibly until the tail end of 2022.

Equity markets were tested twice by inflation related sell-offs during the quarter. Commodity prices continued rising into May before China vowed to crack down on commodity speculation and released industrial metal reserves to stabilise prices. There was some volatility following the June Federal Open Market Committee meeting which indicated an earlier rate hike. Fund manager surveys showed that inflation had replaced Covid-19 as the number one risk to the economy but the crowded inflation protection trade has begun to unwind. Banks, Materials, cyclical and value stocks, which have performed well year-to-date, have underperformed technology and growth since that meeting.

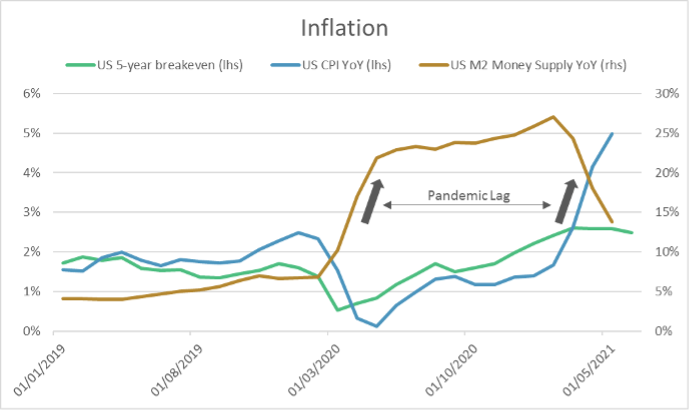

The extent to which inflation is transitory is the biggest question for investors and, while we cannot say this with any certainty, there are some indications that it may be. A global semiconductor shortage has hindered automobile production forcing higher prices for second-hand autos and these have formed a significant component of consumer price increases. Crude oil prices are now at pre-pandemic levels, so the energy component may settle from here. Service consumption is still well below pre-pandemic levels so a shift in demand from goods as economies begin to reopen should ease capacity constraints. This should also benefit shipping and haulage costs; there is currently a dearth of truck drivers across developed economies. It is notable, however, that we have yet to see a contraction in durable good purchases and many manufacturers have yet to pass even higher producer prices through to consumers. In the near-term, we may find service inflation rises before goods inflation begins to wane.

Over the long-term we may be entering a period of above trend inflation. The Federal Reserve is more willing to allow inflation to run higher over the medium term and is prioritising full employment. The last decade was characterised by a huge expansion in global supply potential with the integration of China and a proliferation of supply chain technologies that was ultimately deflationary – but has this run its course? High levels of debt, aging demographics and progressive technologies are three factors which promote low inflation, the consequence of which may be a greater inclination to use helicopter money as a regular policy tool. Balancing these factors and weighing the size of fiscal stimulus, the US appears to be more susceptible to inflation risk than other nations. This is already apparent in core inflation data which has reached 3.8% compared to 1.0% in Developed Markets excluding the US, but breakeven bond spreads suggest this will fall back below 2.5%.

What is surprising is the reaction from bond markets. Despite inflation concerns and talk of Fed tapering, the US yield curve has flattened and US 10-year treasuries now trade at 1.49% vs 1.74% at the start of the quarter. While equities appear to be expensive compared to historical ratios such as cyclically adjusted price-to-earnings, the equity risk premium (the excess return from investing in equities instead of a low risk asset) is at more reasonable levels. If bonds yields begin to move, that may change.

We expect the global economy to continue along its recovery path, with developed market leadership from here, and above trend growth in 2022. The pandemic is waning and, while inflation may be at a peak, so too may be loose policy. The pace of tapering, introduction of taxes and the removal of fiscal support are hurdles that lie ahead. After an incredible first half for risk assets, we anticipate a period of consolidation. We have taken profits towards the end of the quarter but, on balance, remain positive and do not see sufficient risk to adopt a more defensive position.