Déjà vu

Much like the clean energy revolution taking place today, many years before the oil boom of the 19th century, wood had been displaced by its more efficient coal counterpart. Coal yields approximately 4 times the energy from its equivalent weight in wood. Coal powered steam engines enabled transportation over land and sea to increase rapidly. Innovation in steam engines led to large scale manufacturing and increased output. This efficiency however came at the cost of poor emissions. Coal produced a thick black smoke that enveloped most cities around the globe. Over time conditions globally had deteriorated to such a point that activists all over the world were lobbying against coal and conditions were ripe for a cleaner energy alternative. The oil market had its beginnings in 1859 after the discovery of oil in Pennsylvania. At the time it offered a much cleaner alternative to coal. The spark was a breakthrough in how oil was drilled using a sleeve to support the well from collapsing.

Landscape of the oil market today

The Organization of Petroleum Exporting Countries (OPEC) formed in 1960. OPEC is responsible for about 32% of the world’s oil supply. The biggest crude supplier within OPEC is Saudi Arabia who represent 31% of OPEC and 10% globally. Even though OPEC is one of the bigger players in the oil market, their dominance has weakened over the last 10 years which is why Russia has an important role to play; they supply 13% of global production. We often hear of ‘OPEC plus’ reaching agreement. This includes Russia and OPEC and represents 45% of the global oil supply. The oil suppliers need to reach agreement to stabilise the market in these unprecedented times where COVID has disrupted oil demand.

US shifts the balance of power

The oil market started in 1959 with its 1st year annual oil production of 2,000 barrels. 10 years later this had risen to 4m barrels per annum, and by 1973 this had increased to 10m barrels per annum. It is hard to believe, but today the globe is consuming a staggering 100m barrels, not per annum but per day! It’s no wonder the activists are back and the renewable revolution is getting stronger every year.

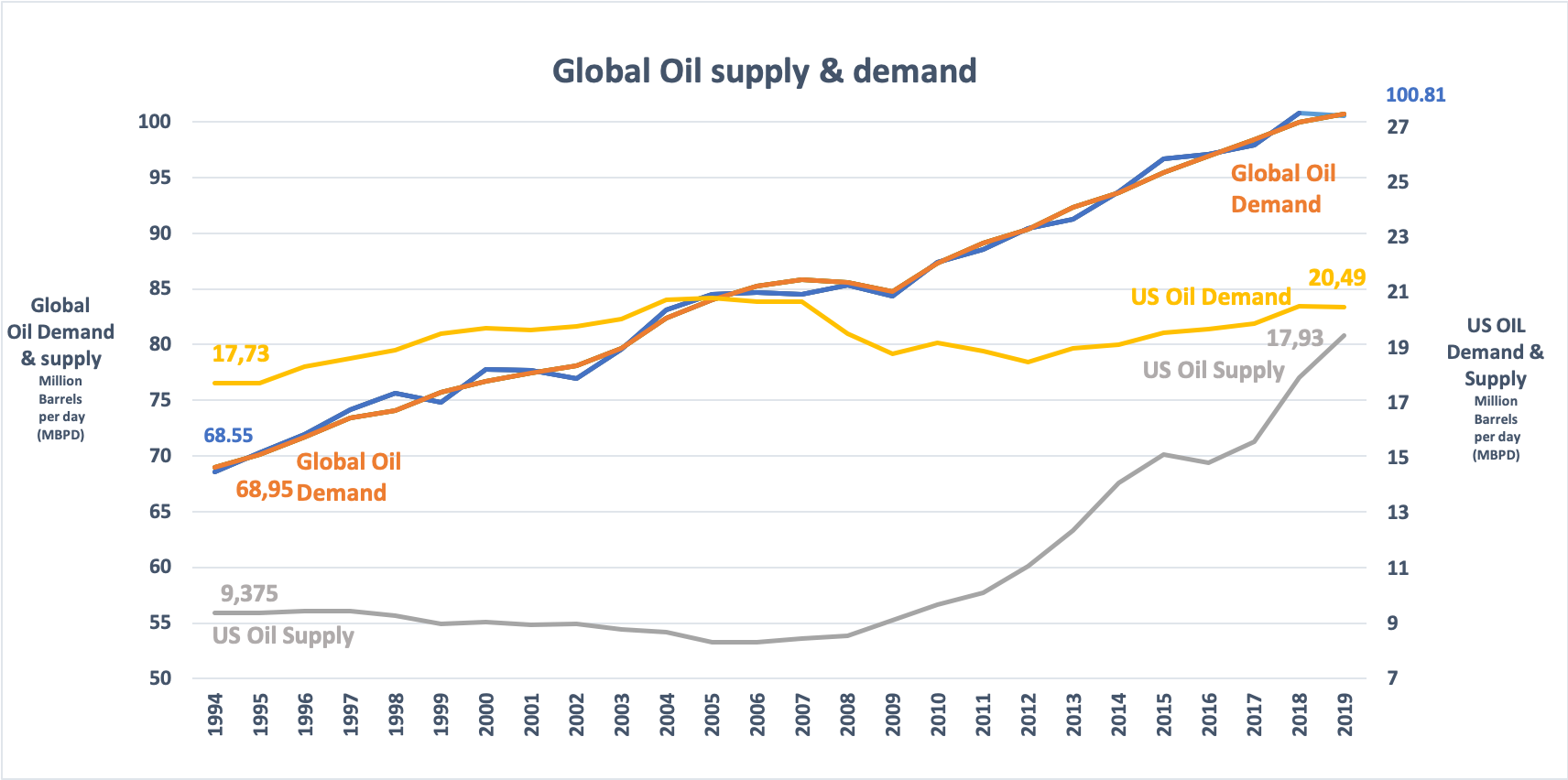

The most significant shift in the oil market has been the US oil supply increase over the last 10 years from under 9m barrels a day in 2008 to over 18m barrels today (see yellow line in chart below). Technological advancement between 1997 and 2009 accelerated the production of oil in the US shale. Other than the strategic independence this gives the US, when one considers the growth in demand from China over the last 10 years, you have to wonder what position OPEC would have been in had the US not developed the additional supply. Oil prices would probably be well over $100 and we would see a very different balance of power in the energy sector.

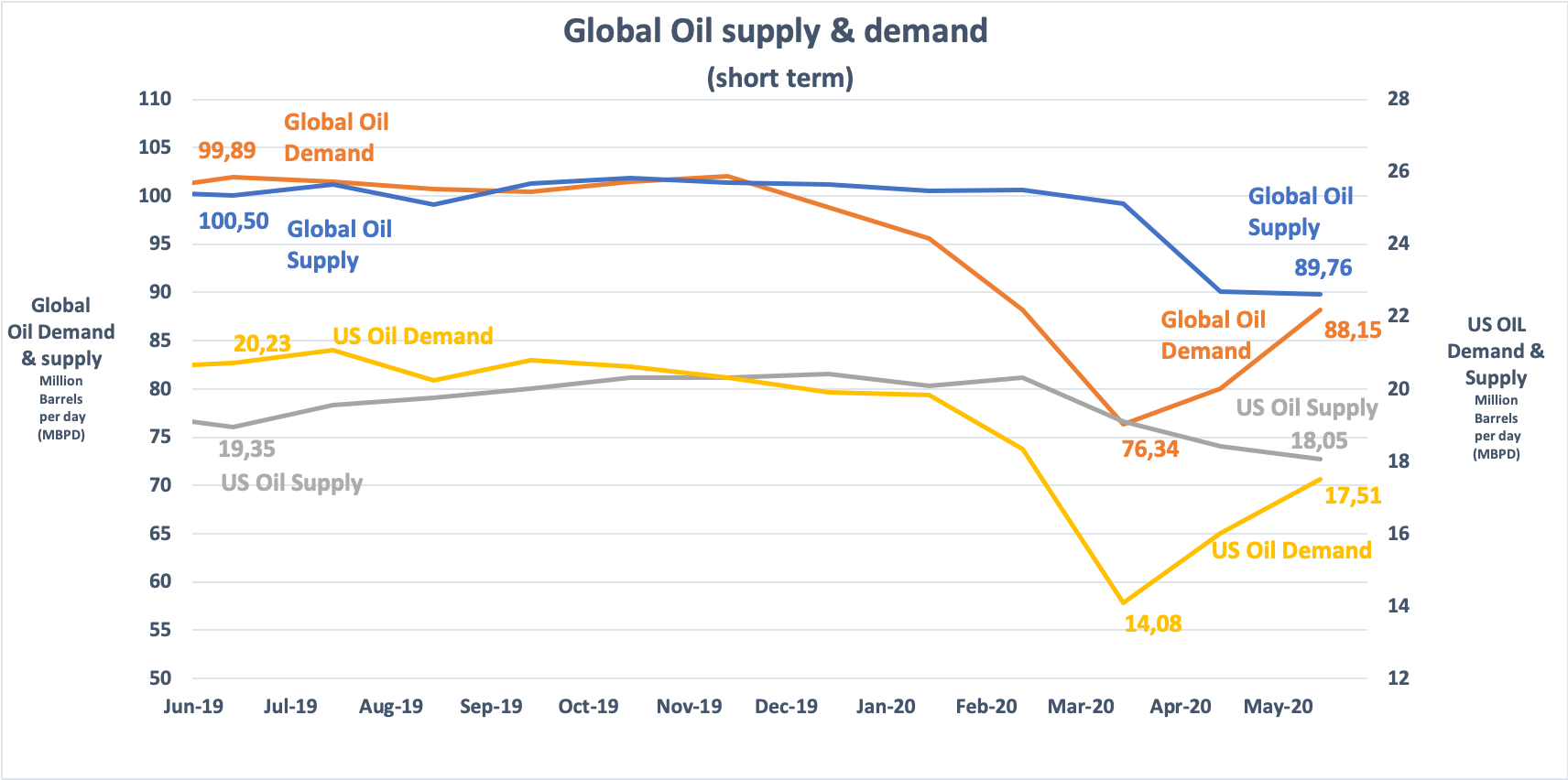

The effects of COVID plunged the oil market to its low in March and April this year. Global demand dropped 24% from 100m barrels per day to its low of 76m barrels per day. The recovery in the oil market, as at 25th June, witnessed a 16% increase in demand back to 88m barrels per day. This demand increase alone was not enough to stabilize global oil prices. Oil producing countries like ‘OPEC plus’ had to reach agreement to reduce the supply and bring it to parity with demand.

Through this crisis, the short-term over supply of oil was largely absorbed through available storage. As the chart below shows, the US storage came very close to full capacity over May and June 2020. These storage levels are not unfamiliar to the US as these levels were seen in 2017.

Conclusion

US Crude storage normalized over a relatively short period from 2017 to 2019 demonstrating how resilient the oil market can be to these shocks and putting the recent market movements into some perspective. Demand and supply of oil have been largely stabilized by suppliers working together. Prices however need to still recover to around $55 for most major producers to supply the market profitably. Major oil producers like BP and Shell have been writing off billions in invested capital at current oil prices. BP and Shell are the most conservative of the large producers, forecasting a longer-term oil price of $55. The remaining large global producers have pricing outlooks ranging all the way up to $80. The longer it takes for oil prices to recover, the more oil companies we will see cutting back production or declaring bankruptcy. However, the basic laws of economics will ultimately prevail if oil prices do not recover to pre COVD levels. Unprofitable oil producers will go from production cuts to closures. The result will be a further reduction of oil supply which will ultimately drive oil prices higher.

The one effect COVID might have on the global energy sector is accelerating the redirection of investment from carbon-based energy to clean energy alternatives. We are seeing large energy companies make bigger and bigger investments into renewable energy while at the same time cutting back on investment into traditional carbon-based energy projects. In addition to the large write-offs companies are having to make in this weak environment, the appetite of investors for carbon based projects is fast dwindling as ESG (Environmental, Social & Corporate Governance) becomes an ever increasing part of how energy companies are rated.