Case Progression

Overall the picture in Europe is encouraging, with a collapse in new case rates since early April. The UK, France, Germany, Italy and Spain all have case rates of less than 8 per million of population. To put this into perspective, the case rate in Spain peaked at 182 per million, reflecting a 96% reduction in cases as illustrated in the chart below.

However, the picture elsewhere is less clear. New cases in the US have surged over the past few weeks from around 60 cases per million of population a month ago to over 150 per million today. This is in part due to increasing levels of testing, but also reflects how the disease has spread across the continent. States initially worse affected such as New York are now experiencing greatly reduced caseloads, while much of central America are still in the exponential stages of regional outbreaks.

From a global perspective, the virus is far from under control. Latin America, Africa and India are all still in the exponential phase of the spread, with Brazil now the most severely affected country. The pace of increase in these areas is more than offsetting the improvement in Europe, and globally case rates continue to grow at close to exponential rates, with an average of 24 new cases per million of population currently.

Mortality Progression

The data with regards to mortality progression is clearer and shows a remarkably consistent picture across countries.

It is extremely encouraging to see that mortality rates in Europe have fallen dramatically with virtually all countries including the UK now below 1 per million of population. Despite the increase in cases in the US, the mortality rate continue to improve with rates down to 1.4 per million and falling.

Mortality rates in Brazil, South Africa and India are also better than we might have expected from looking at the number of new cases. This may reflect younger age demographics, warmer climates or simply less reporting.

There is growing evidence to suggest that the virus may be weakening or at least the viral load experienced by infected persons is typically lower than it was in March. It is not clear whether this is due to mutations in the virus or simply down to social distancing and improved hygiene awareness. This is reflected in the falling rates of hospital admissions despite persistent new case rates.

At the same time, treatment strategies have improved as the medical understanding of the disease has increased. The success of the clinical trial of Dexamethasone is particularly encouraging. This cheap, abundant and well understood anti-inflammatory steroid will save thousands of lives. The combined effects of these developments make COVID-19 more manageable and enables economic activity to resume more rapidly.

Remarkably excess deaths in the UK have now fallen below the 5 year average for the past two weeks, as illustrated below:

Rate of Infection (R)

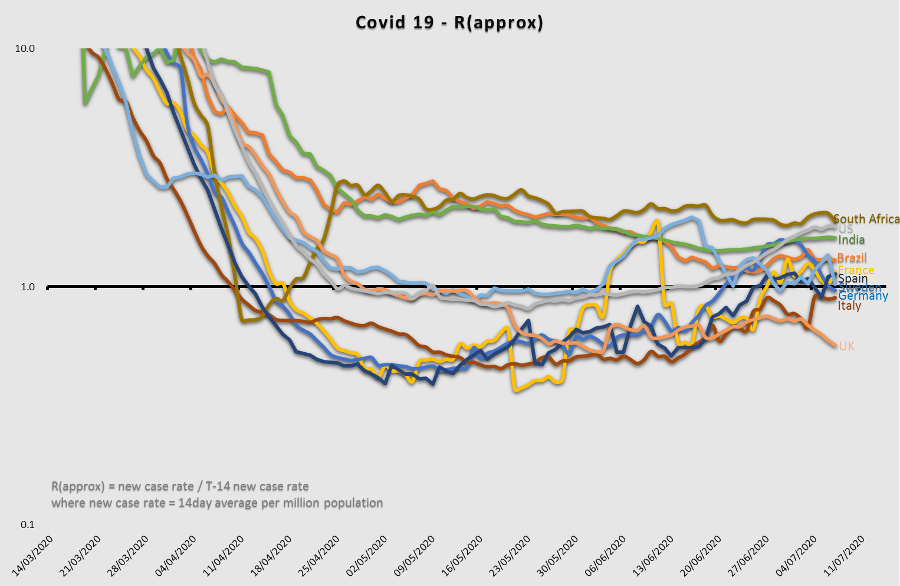

We estimate the rate of infection, or R, for countries in the chart below. An R of 1 indicates a stable level of infection. Below 1 and the infection level is falling. An R of 0.5 on this chart indicates that the rate of infection is halving every 14 days. An R level above 1 indicates rising infection levels; an R of 2 for example means that the rate of infection is doubling every 14 days.

R rates in Europe have been significantly below 1 since around the middle of April, but have increased in the last week, with Germany in particular seeing its R rate rise above 1 for the first time in two months. It is likely this reflects small, manageable local outbreaks relative to a low overall infection rate, rather than the first signs of a second wave, but this needs careful monitoring.

The US has risen significantly above 1 again, reflecting a surge of new cases that is much more concerning, with the UK R rate now above that of both India and Brazil. The South African R rate remains stubbornly high.

The risk of an uncontrollable second wave in Europe during the summer months now appears relatively low; however, with the virus continuing to spread rapidly in the southern hemisphere, the real risk is that the virus may return in a second wave as we head into winter.